Young drivers seem to get it the hardest when paying for a car. Not only with the cost of a vehicle being a costly investment at a younger age, these drivers will pay more for insurance than their older counterparts. Car insurance for younger drivers varies due to a number of factors, including inexperience, increased likelihood to take risks, inability to control the car and more.

As a result, car insurance for young drivers is expensive which can quickly make a car unaffordable and inaccessible. That’s why we’re exploring why car insurance costs are determined by age, what the statistics have to say and if car insurance for young drivers can be affordable.

Let’s dive in!

It’s a Fact, Insurance Differs Depending Age

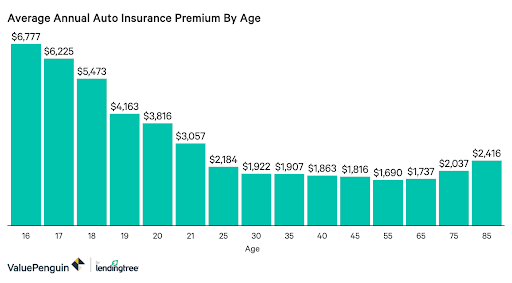

Let’s look at insurance premiums in relation to age. From the off it seems clear that there are two age groups who will be asked to pay the most; the youngest drivers as well as the oldest drivers.

Let’s take a look at the average costs of car insurance by age:

Teenagers will be paying about 3x times more compared to drivers in their mid 30’s, and costs are nearly 4x the rate for an experienced driver in their mid-fifties.

There are several reasons to explain these costs which we will explore below.

Why Do Young Drivers Pay So Much More?

The answer is simple; young drivers are less experienced. According to data and statistics gathered by many insurance companies, it’s clear that the more years a driver has behind the wheel, the less likely that person is to be involved in an accident or crash. Consequently, the less likely they are to submit a claim for reimbursement, meaning car insurance for young drivers if often much higher.

Thus, there is a heightened risk of damage/repairs associated with young drivers. Because of this, insurance companies compensate this risk by asking for a higher premium.

As Brake explains, “Research shows that the combination of youth and inexperience puts younger drivers at high risk. Their inexperience means they have less ability to spot hazards, and their youth means they are particularly likely to take risks. In this way, crash risk not only reduces over time with experience but also is higher for drivers who start driving at a younger age.”

Furthermore, as statistics reveal, “Young drivers (17-24 years old) are at a much higher risk of crashing than older drivers. Drivers aged 17-19 only make up 1.5% of UK licence holders, but are involved in 9% of fatal and serious crashes where they are the driver.”

Some young drivers however, never submit a claim or be involved in an accident. Despite this however, statistics help to explain why young drivers pay more insurance than other age groups.

Are There Affordable Alternatives For Young Drivers?

Considering the higher insurance premiums that young drivers have to pay, it’s worthwhile examining whether there are alternative affordables. The great news is that we now live in a time of innovation, growth and new business. As a result, cheap car insurance is available for young people. One company embodying these values and recognising the problem that high insurance costs pose to young drivers is UbiCar.

UbiCar, is a forward-thinking and progressive company. Employing a customer-centric approach to all that they do, we believe in accessibility for all. That’s why they’re providing cheap car insurance for young drivers.

Rather than charging excessively high premiums which can make buying a car impossible for many young people, UbiCar is presenting a more inclusive alternative. Relying on the latest technology, the company charges its customers based on how they drive.

UbiCar’s app employs telemetrics. Telemetrics uses a black box to talk to UbiCar’s app, allowing customers are charged fairly and relatively. This also encourages drivers to be more considered and safe when driving, as they recognise there are costs involved with unsafe and hazardous driving.

Getting Cheaper Car Insurance Online

Thanks to the digital age that we now live in, we are seeing many technological advancements in insurance. This means we see great benefits for you, the customer. Young drivers once had to pay high insurance premiums without alternative options. Now there are much more affordable choices on when it comes to car insurance for young drivers!

If you’re looking to learn more about the UbiCar and how we can help you, then be sure to get in touch! Our friendly, responsive and knowledgeable team will be sure to provide you with the answer you’re looking for. Simply give us a call, send us an email or say hello on our social media platforms.

Plus, if you’d like to receive your free quote, simply head here!

We look forward to hearing from you.